Best Insurance Marketing Organizations: What to Look For (And What to Avoid)

Most insurance agents choose marketing organizations wrong.

They sign contracts without reading them. They trust promises that aren't in writing. They get locked into bad deals. They can't switch when things go wrong.

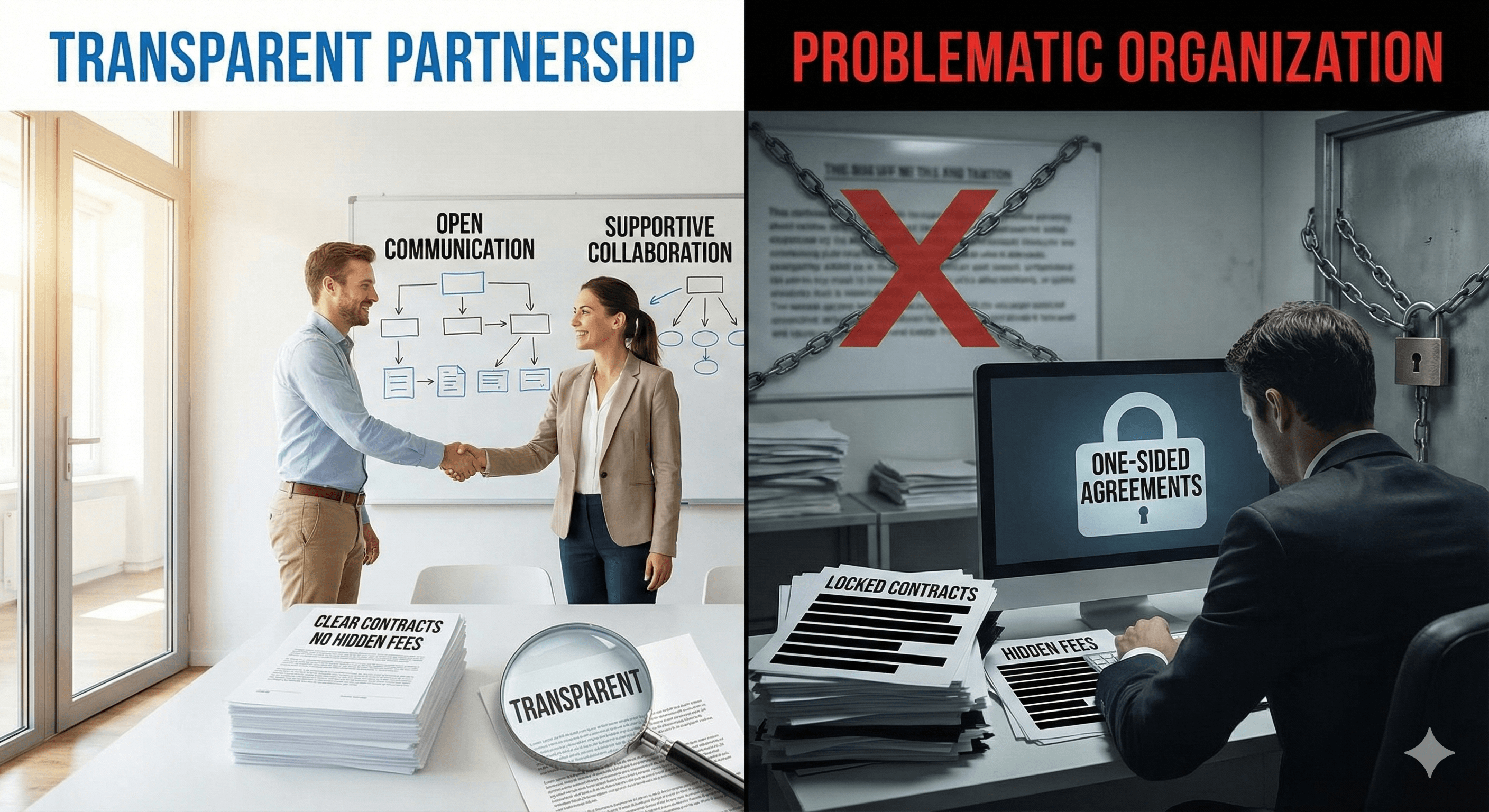

Insurance marketing organizations (FMOs, IMOs, MGAs) are companies that provide agents with carrier access, training, marketing support, and back-office services. The best organizations act as true partners, offering transparent commission structures, comprehensive support, and flexible contracts. The worst organizations lock you into bad deals, hide commission splits, and prioritize recruitment over your success.

Here's how to identify the best organizations. And the red flags that signal trouble.

Great organizations act as partners. Weak organizations act as vendors. The difference is transparency, support, and focus on your success.

What Are Insurance Marketing Organizations?

Insurance marketing organizations come in different forms. Understanding the types helps you choose wisely.

Field Marketing Organizations (FMOs)

FMOs traditionally focused on health insurance and Medicare products. They provide:

- Carrier appointments

- Product training

- Marketing materials

- Commission processing

- Compliance support

Best for: Agents selling Medicare, health insurance, or senior products.

Independent Marketing Organizations (IMOs)

IMOs traditionally focused on life insurance and annuities. They provide:

- Life and annuity carrier access

- Sales training

- Marketing support

- Technology tools

- Back-office services

Best for: Agents selling life insurance, annuities, or financial products.

Managing General Agents (MGAs)

MGAs are smaller organizations that partner with IMOs or FMOs. They manage downline agents and earn overrides.

Best for: Experienced agents who want to build their own team.

Note: The terms FMO, IMO, and MGA are often used interchangeably today. Focus on what they offer, not the acronym.

The 5 Green Flags of Great Marketing Organizations

1. Transparent Commission Structures

Great organizations show you exactly how commissions work.

What to look for:

- Clear commission schedules from carriers

- Written explanation of any overrides or splits

- No hidden fees or charges

- Ability to verify commission rates directly with carriers

Red flag: They won't show you carrier commission schedules. They say "trust us" without proof.

Why it matters: You need to know what you're earning. Hidden commission splits reduce your income without you knowing.

2. Flexible Contracts

Great organizations let you leave if it's not working.

What to look for:

- No-release clauses that are reasonable (30-90 days, not years)

- Clear exit terms in writing

- Ability to transfer business if you leave

- No penalties for switching organizations

Red flag: Contracts with no-release clauses longer than 90 days. Or contracts that lock you in permanently.

Why it matters: You need flexibility. If the organization stops supporting you, you should be able to leave. Locked contracts trap you in bad situations.

3. Comprehensive Support Services

Great organizations provide real support, not just carrier access.

What to look for:

- Training programs (not just product training, but sales training)

- Marketing materials and tools

- Technology platforms (CRM, quoting tools, automation)

- Back-office support (commission tracking, compliance)

- Dedicated support person or team

Red flag: They give you carrier access and nothing else. No training. No marketing help. No technology.

Why it matters: Carrier access alone doesn't help you succeed. You need training, marketing support, and technology to compete.

4. Strong Carrier Relationships

Great organizations have relationships with quality carriers.

What to look for:

- Access to top-rated carriers (A+ or better)

- Competitive products and rates

- Fast underwriting and policy issuance

- Good claims-paying ability

Red flag: They only offer access to low-rated carriers. Or carriers with poor service.

Why it matters: You can't sell products from carriers that don't pay claims or have poor service. Your reputation depends on carrier quality.

5. Focus on Your Success, Not Their Growth

Great organizations help you succeed. Weak organizations focus on recruiting more agents.

What to look for:

- Support for existing agents

- Resources for agent success

- Focus on helping you sell, not recruiting

- Success stories from current agents

Red flag: They constantly push you to recruit. They care more about your downline than your sales.

Why it matters: You need an organization that helps you succeed, not one that uses you to build their network.

The 7 Red Flags That Signal Trouble

Red Flag #1: Locked Contracts

If they won't let you leave, that's a problem.

What to avoid:

- Contracts with no-release clauses longer than 90 days

- Contracts that lock you in permanently

- Organizations that won't discuss release terms

Why it's bad: You're trapped. If support stops, you can't leave. You're stuck in a bad situation.

Red Flag #2: Unclear Commission Structures

If they won't show you how commissions work, that's a problem.

What to avoid:

- Organizations that won't show carrier commission schedules

- Vague explanations of overrides or splits

- "Trust us" without proof

Why it's bad: You don't know what you're earning. Hidden commission splits reduce your income.

Red Flag #3: Limited Support

If they only provide carrier access, that's not enough.

What to avoid:

- No training programs

- No marketing materials

- No technology tools

- No back-office support

Why it's bad: You need support to succeed. Carrier access alone doesn't help you sell.

Red Flag #4: Overemphasis on Recruitment

If they push you to recruit more than they help you sell, that's a problem.

What to avoid:

- Constant pressure to build a downline

- More resources for recruiting than selling

- Focus on network growth over agent success

Why it's bad: They care more about their growth than yours. You're a number, not a partner.

Red Flag #5: Lack of Transparency

If they won't put promises in writing, that's a problem.

What to avoid:

- Verbal promises not in contracts

- Refusal to provide written documentation

- Vague answers to direct questions

Why it's bad: Verbal promises aren't enforceable. If it's not in writing, it doesn't exist.

Red Flag #6: Poor Technology

If their systems are outdated or don't work, that's a problem.

What to avoid:

- Outdated quoting tools

- No CRM or automation

- Poor website or portal

- No mobile access

Why it's bad: You need modern tools to compete. Outdated technology slows you down.

Red Flag #7: Negative Reviews or Reputation

If other agents warn you away, listen.

What to avoid:

- Multiple complaints online

- Agents who left and warn others

- Poor Better Business Bureau ratings

- Industry reputation issues

Why it's bad: Where there's smoke, there's fire. If multiple agents have problems, you will too.

What to Ask Before Joining

Don't sign anything until you ask these questions:

Commission Questions:

- "Can I see the carrier commission schedules?"

- "What overrides or splits do you take?"

- "How are commissions processed and paid?"

- "Are there any hidden fees?"

Contract Questions: 5. "What are the release terms?" 6. "Can I transfer my business if I leave?" 7. "Are there any penalties for switching organizations?" 8. "Can I see the full contract before signing?"

Support Questions: 9. "What training do you provide?" 10. "What marketing materials and tools are included?" 11. "What technology platforms do you offer?" 12. "Who is my dedicated support person?"

Carrier Questions: 13. "Which carriers do you have relationships with?" 14. "What are the carrier ratings?" 15. "How fast is underwriting and policy issuance?" 16. "Can I get appointed with carriers directly if I want?"

Success Questions: 17. "Can you share success stories from current agents?" 18. "What's the average agent production?" 19. "How do you help agents succeed?" 20. "What makes you different from other organizations?"

Get everything in writing. If they won't put it in writing, that's a red flag.

The Partnership vs. Transaction Mindset

Great organizations act as partners. Weak organizations act as vendors.

Partnership mindset:

- They invest in your success

- They provide ongoing support

- They care about your results

- They're transparent about everything

Transaction mindset:

- They collect commissions

- They provide minimal support

- They care about their growth

- They're vague about details

How to tell the difference:

Ask: "How do you help agents succeed?"

Partnership answer: "We provide comprehensive training, marketing support, technology tools, and dedicated support. Here are success stories from current agents. Here's our training calendar. Here's our technology platform."

Transaction answer: "We give you carrier access. That's what you need. Sign here."

Choose partners, not vendors.

What Great Marketing Organizations Actually Provide

Beyond carrier access, great organizations provide:

Training:

- Product training (understand what you're selling)

- Sales training (how to close deals)

- Marketing training (how to generate leads)

- Technology training (how to use their tools)

Marketing Support:

- Pre-made ad campaigns

- Email templates

- Landing page templates

- Social media content

- Direct mail templates

Technology:

- CRM systems

- Quoting tools

- Automation platforms

- Mobile apps

- Reporting dashboards

Back-Office Support:

- Commission tracking

- Compliance monitoring

- Policy administration

- Claims support

- Renewal management

If they only provide carrier access, that's not enough.

How to Evaluate Marketing Organizations

Use this checklist before signing:

Commission Transparency:

- Can see carrier commission schedules

- Understand override structure

- No hidden fees

- Commission processing is clear

Contract Flexibility:

- Release terms are reasonable (30-90 days max)

- Can transfer business if leaving

- No permanent lock-in

- Exit terms are clear

Support Services:

- Training programs available

- Marketing materials provided

- Technology tools included

- Dedicated support person

Carrier Quality:

- Access to A+ rated carriers

- Competitive products

- Fast underwriting

- Good service reputation

Organization Reputation:

- Positive reviews from agents

- Good industry reputation

- Transparent about everything

- Focus on agent success

If they check all boxes, that's a good organization. If they miss multiple boxes, that's a red flag.

The Bottom Line

Choosing an insurance marketing organization is a big decision. Choose wrong, and you're locked into a bad situation. Choose right, and you have a true partner.

The best organizations are transparent about commissions, flexible with contracts, comprehensive in support, strong in carrier relationships, and focused on your success, not their growth.

The worst organizations lock you into bad contracts, hide commission structures, provide minimal support, offer weak carriers, and prioritize recruitment over your success.

Don't sign anything until you've asked the hard questions. Get everything in writing. Check their reputation. Talk to current agents.

Stop getting locked into bad deals. Start choosing true partners.

Learn more about insurance marketing strategies.

See how we help agents succeed.