How to Find Qualified Annuity Leads

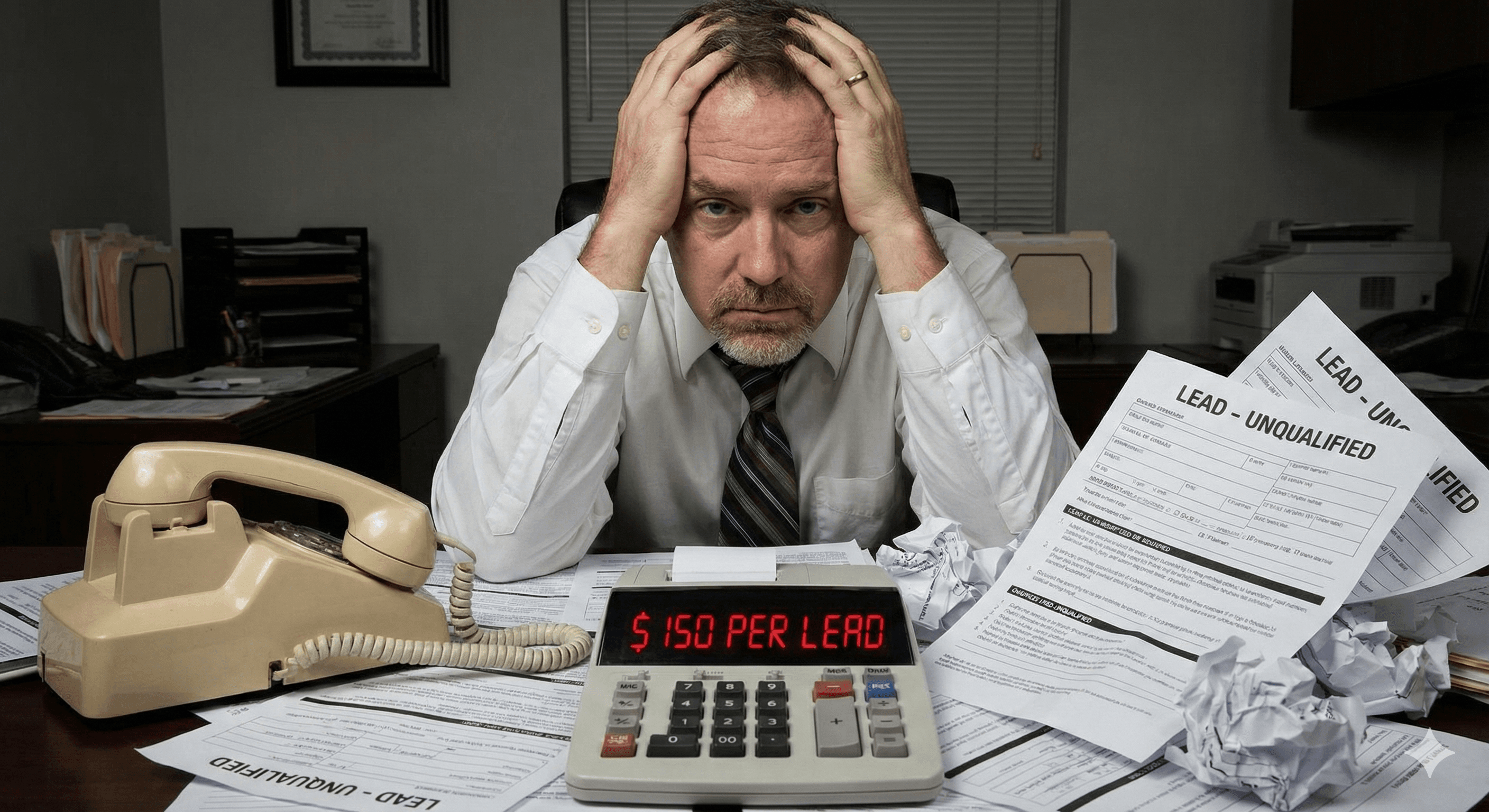

Most annuity agents waste $50,000+ per year chasing unqualified leads. They buy shared leads for $250-$500 each. They cold call strangers. They attend networking events. They hope referrals come. The math is brutal. The results are worse.

The top 1% of annuity producers don't do any of this. They run systems that generate qualified leads. These are prospects who meet specific criteria, have consumed your educational content, and are ready to buy before you ever speak. The difference isn't budget. It's qualification.

How to find qualified annuity leads means identifying prospects who meet specific demographic, financial, and behavioral criteria before investing time in sales conversations. Unlike unqualified leads who need education and trust-building, qualified annuity leads have self-selected through content consumption, understand annuities, and are ready to discuss products. The qualification process eliminates cold objections and increases close rates from 5-10% to 40-60%.

Most agents waste $50,000+ per year on unqualified leads that don't convert.

The Qualification Framework: What Makes an Annuity Lead Qualified

Most agents confuse "interested" with "qualified." They're not the same. An interested prospect might click an ad. A qualified prospect meets specific criteria and is ready to buy.

The Five Qualification Criteria:

1. Demographic Qualification

Age: 45-70 years old

- Too young (under 45): Not yet focused on retirement income

- Too old (over 70): May have already made decisions, RMD requirements complicate planning

Life Stage: Approaching or in retirement

- 5-10 years before retirement: Planning phase, open to education

- Recently retired: Income needs are immediate

- Early retirement: 5-10 years in, evaluating strategies

Income: $75,000+ household income

- Below this threshold: May not have sufficient assets for annuities

- Above this threshold: More likely to have investable assets

2. Financial Qualification

Investable Assets: $100,000+ available

- Below $100K: Annuity products may not be suitable

- $100K-$500K: Ideal for fixed and indexed annuities

- $500K+: Can consider variable annuities, multiple products

Current Savings Vehicles:

- 401(k) or IRA balances: Indicates retirement planning awareness

- CDs or money market accounts: May be seeking better returns

- Stock market exposure: May want downside protection

Debt Situation:

- Low debt-to-income ratio: More assets available for annuities

- High debt: May need to address debt before annuity planning

3. Psychographic Qualification

Risk Tolerance: Moderate to conservative

- Aggressive investors: Less likely to want annuities

- Conservative investors: Ideal candidates for fixed/indexed annuities

Income Focus: Concerned about guaranteed income

- Worried about outliving savings: Strong annuity candidate

- Seeking tax-deferred growth: Variable annuity candidate

- Want market protection: Indexed annuity candidate

Planning Mindset: Proactive about retirement

- Already planning: More likely to engage

- Reactive: May need more education before qualifying

4. Behavioral Qualification

Content Consumption: Watched 10-15 of your videos

- Multiple views: Shows genuine interest

- Single view: May be casual browsing

- No views: Cold lead, not qualified

Engagement Level: Downloaded resources, booked appointment

- Took action: Self-qualified through behavior

- No action: Not ready, needs nurturing

Response Time: Booked within 48 hours of content consumption

- Quick booking: High intent, qualified

- Delayed booking: Lower intent, may need more education

5. Timing Qualification

Life Events: Recent trigger events

- Approaching retirement: High qualification

- Job change: May have 401(k) rollover opportunity

- Inheritance: Sudden wealth, needs planning

- Market volatility: Seeking protection

Urgency: Has expressed time-sensitive need

- "I need to decide soon": Qualified

- "Just exploring": Needs more education

The Qualification Score:

Rate each prospect 1-10 on each criterion. Total score of 35+ = qualified. Below 35 = needs more education or disqualify.

Why Most "Qualified" Leads Aren't Actually Qualified

Lead vendors claim their leads are "qualified." They're not. Here's why:

The Vendor Qualification Lie:

Vendors say leads are qualified because they:

- Filled out a form

- Clicked an ad

- Downloaded a guide

- Attended a webinar

This isn't qualification. This is interest. Qualification requires meeting all five criteria above.

The Shared Lead Problem:

You pay $250-$500 for a "qualified" lead. That lead is sold to 4-6 other agents. The prospect gets 6 calls in one day. They're annoyed. They don't answer. Your contact rate: 10-20%. Your close rate: 5-10%.

The Math:

50 "qualified" leads × $300 = $15,000 spent 5-10 contacts made (10-20% contact rate) 1-2 appointments booked (20-40% show rate) 0-1 sales closed (5-10% close rate)

True cost per sale: $7,500-$15,000

This isn't qualification. This is expensive hope.

The Branded Lead System: True Qualification at Scale

The top 1% of annuity producers use a framework called branded lead generation. It's not a tactic. It's a complete qualification system.

The Core Principle:

Prospects must self-qualify through content consumption before you invest time in sales conversations. This eliminates unqualified leads automatically. Only qualified prospects reach your calendar.

The Four-Phase Qualification System:

Phase 1: Attraction (Video Ads)

You run short-form video ads (3-8 seconds) on Facebook, Instagram, and TikTok. These aren't sales pitches. They're micro-educational moments that attract qualified prospects.

Ad Script Formula:

- Hook (first 2 seconds): State a surprising fact

- Educate (next 3-5 seconds): Provide valuable insight

- Curiosity gap (final second): Tease the solution

Example Script:

"Most retirees don't realize their 401(k) can run out. If you have $500K saved and withdraw $2,000 per month, your money lasts 20 years. But what if you live 25 years? Here's how annuities solve this..."

The ad doesn't sell. It educates. It attracts qualified prospects who are thinking about these problems.

Why This Works:

Qualified prospects watch 10-15 of these ads. They start recognizing your face, your voice, your expertise. When they see your booking page, they're not thinking "Who is this agent?" They're thinking "I've seen this agent before. They know what they're talking about."

This is the mere exposure effect. Familiarity breeds trust. Trust breeds action.

Phase 2: Education (Landing Page)

Your video ads drive to a dedicated landing page. The page has one job: capture contact information from qualified prospects in exchange for valuable education.

The Offer Formula:

- Specific (not "Free Consultation")

- Valuable (solves a real problem)

- Low commitment (doesn't require a sales call)

High-Converting Offer Examples:

- "Get Your Free Retirement Income Calculator: See How Much You Need to Retire Comfortably"

- "Download: The 5 Questions Every 50+ Year Old Should Ask Before Buying an Annuity"

- "Free Analysis: How to Protect Your Retirement from Market Volatility"

Landing Page Essentials:

- Headline that matches the ad promise

- Social proof (testimonials, case studies, credentials)

- Objection handling (address common concerns)

- Single, clear call-to-action

- Mobile-optimized design

The page must load in under 3 seconds. 53% of mobile users abandon sites that take longer.

Phase 3: Nurture (Automated Sequence)

Once a prospect enters your system, automation takes over. They receive a sequence of emails and text messages that:

- Deliver the promised content immediately

- Answer common questions preemptively

- Pre-frame the sales conversation

- Build urgency without being pushy

The Sequence Structure:

- Email 1 (Immediate): Deliver the promised content

- Email 2 (Day 2): Answer common objection

- Email 3 (Day 4): Share case study or success story

- Email 4 (Day 7): Soft invitation to book a call

- Email 5 (Day 10): Final value-add before close

This sequence runs 24/7. You're not manually following up. The system works while you sleep.

Why Automation Matters:

Studies show it takes 8-12 touchpoints to convert a lead. Most agents make 1-2 attempts. Automation ensures every lead gets the full sequence. Only qualified prospects who engage throughout the sequence book appointments.

Phase 4: Conversion (Warm Appointment)

By the time a prospect books a call with you, they've:

- Watched 10-15 of your videos

- Consumed your educational content

- Received multiple touchpoints from your automated sequence

- Self-qualified by taking action

You're not making a cold call. You're having a consultation with someone who already trusts you and is qualified.

The Results (Real Data from Top Producers):

- Show rate: 85-95% (vs. 30-40% for cold leads)

- Close rate: 40-60% (vs. 5-10% for cold leads)

- Cost per sale: $200-800 (vs. $7,500-$15,000 for cold leads)

- Time investment: 5-10 hours/month (vs. 150 hours/month for cold leads)

The difference isn't small. It's 10x better.

Advanced Targeting: Finding Your Ideal Qualified Prospect

Most agents target too broadly. They try to serve everyone. That's a mistake. The best agents target specific niches. Here's how to find yours.

The Niche Framework:

- Demographics: Age, income, net worth, location

- Psychographics: Values, goals, pain points

- Life Stage: Pre-retirement, retirement, post-retirement

- Trigger Events: Job change, inheritance, retirement, market volatility

Example Niche Profiles:

Niche 1: Pre-Retirement Executives (Ages 50-65)

- Income: $150K+

- Net worth: $500K-$2M

- Pain point: Not sure if they can retire

- Trigger: Approaching retirement age

- Offer: "Retirement Readiness Assessment"

Niche 2: Recent Retirees (Ages 60-70)

- Income: $75K-$150K

- Net worth: $300K-$1M

- Pain point: Need guaranteed income

- Trigger: Recently retired

- Offer: "Guaranteed Income Strategy Guide"

Niche 3: Risk-Averse Investors (Ages 55-70)

- Income: $100K+

- Net worth: $500K+

- Pain point: Worried about market volatility

- Trigger: Market downturn

- Offer: "Market Protection Strategy"

Why Niches Work:

When you target a specific niche, your messaging resonates. Your ads speak directly to their problems. Your offers solve their specific needs. Conversion rates increase 3-5x.

How to Choose Your Niche:

- Look at your best clients. What do they have in common?

- What problems do you solve best?

- What market has money and needs help?

- What can you talk about for hours?

Start with one niche. Master it. Then expand.

The Math: Qualified vs. Unqualified Leads

Let's compare the two models with real numbers:

Unqualified Lead Buying (50 leads/month):

- Cost: $15,000/month ($300 per lead)

- Contacts: 5-10/month (10-20% contact rate)

- Appointments: 1-2/month (20-40% show rate)

- Sales: 0-1/month (5-10% close rate)

- Cost per sale: $7,500-$15,000

- Time investment: 150 hours/month

Qualified Branded Lead System (Optimized):

- Cost: $3,000-5,000/month (ad spend + service/education)

- Contacts: 20-40/month (automated system)

- Appointments: 15-30/month (85-95% show rate)

- Sales: 6-18/month (40-60% close rate)

- Cost per sale: $200-800

- Time investment: 5-10 hours/month (mostly closing)

The 12-Month Comparison:

Unqualified: $180,000 spent, 6-12 sales, $7,500-$15,000 per sale Qualified: $36,000-60,000 spent, 72-216 sales, $200-800 per sale

The qualified system costs less upfront but delivers 10x the ROI. More importantly, it's an asset. Every month you run it, you're building a database of qualified prospects, improving your ad performance, and creating a predictable revenue stream.

Unqualified lead buying is a recurring expense with diminishing returns. Qualified branded lead generation is a capital investment that compounds.

Compliance: Staying Legal While Qualifying Leads

Annuity agents face strict regulations. Here's how to stay compliant while qualifying leads.

Key Compliance Rules:

- Advertising Disclosures: All ads must include required disclosures

- Testimonials: Must follow FINRA and SEC guidelines

- Claims: Cannot make unsubstantiated performance claims

- Privacy: Must comply with GDPR, CCPA, and other privacy laws

- Do Not Call: Must scrub against DNC lists

Best Practices:

- Review all ad copy with compliance before publishing

- Include required disclaimers on landing pages

- Get written permission for testimonials

- Document all client interactions

- Use compliant email marketing tools

- Scrub all lists against DNC registry

Common Violations:

- Making performance guarantees

- Using client testimonials without permission

- Not including required disclosures

- Sharing client information without consent

- Calling numbers on DNC list

The Safe Approach:

When in doubt, be conservative. It's better to be compliant than creative. Work with compliance experts. Review everything before it goes live.

The 7 Deadly Mistakes (And How to Avoid Them)

Mistake #1: Confusing Interest with Qualification

Interest isn't qualification. A prospect who clicks an ad is interested. A prospect who meets all five criteria and has consumed your content is qualified.

The Fix: Use the five-criteria framework. Score each prospect. Only invest time in 35+ scores.

Mistake #2: Buying "Qualified" Leads from Vendors

Vendors claim leads are qualified. They're not. They're interested. There's a difference.

The Fix: Build your own qualification system. Don't outsource qualification to vendors who don't know your criteria.

Mistake #3: Not Tracking Qualification Metrics

Most agents don't track what makes a lead qualified. They guess. Guessing is expensive.

The Fix: Track these metrics:

- Demographic match rate

- Content consumption rate

- Engagement level

- Show rate

- Close rate

Mistake #4: Targeting Too Broadly

Trying to serve everyone means serving no one well. Broad targeting attracts unqualified prospects.

The Fix: Choose a niche. Target specifically. Master it. Then expand.

Mistake #5: Skipping the Education Phase

Annuities are complex. Prospects need education before they're qualified to buy. Skipping education means talking to unqualified prospects.

The Fix: Build education into your system. Prospects must consume content before booking.

Mistake #6: Not Automating Qualification

Manual qualification doesn't scale. You can't personally qualify every prospect.

The Fix: Automate the qualification process. Let prospects self-qualify through content consumption.

Mistake #7: Ignoring Compliance

Compliance violations can end your career. Don't risk it.

The Fix: Review everything with compliance. When in doubt, be conservative.

The Two Paths: Build vs. Buy

You have two options. Both work. The choice depends on your timeline, capital, and long-term goals.

Path 1: Learn and Build It Yourself

This requires investing in education and dedicating 10-20 hours per week to learning ad platforms, copywriting, and funnel construction. The upfront cost is time, but you own the system forever.

What You'll Learn:

- Video ad creation and optimization

- Landing page design and conversion optimization

- Email and SMS automation sequences

- Ad platform management (Facebook, Instagram, TikTok)

- Analytics and ROI tracking

- A/B testing and optimization

Timeline: 60-90 days to see consistent results Investment: Education cost + ad spend ($2,000-5,000/month) ROI: Once optimized, you own a system that generates qualified leads for years

Our S.C.A.L.E. course teaches financial professionals the complete framework for building branded lead systems. You learn how to create video ads, build funnels, set up automation, and optimize for ROI. It's the most powerful long-term investment you can make in your practice.

Best For: Agents who want to own the system long-term and have time to learn.

Path 2: Done-For-You Service

If you need results faster and have the capital, a done-for-you service builds and manages the entire system for you. You receive exclusive, qualified appointments directly in your calendar.

What You Get:

- Professional video ad creation

- Optimized landing pages

- Automated nurture sequences

- Ad campaign management

- Ongoing optimization

- Performance reporting

Timeline: 30-60 days to see consistent results Investment: Monthly service fee + ad spend ROI: Predictable cost-per-acquisition with minimal time investment

We offer a done-for-you branded lead service that handles everything: ad creation, funnel building, automation setup, and optimization. You focus on closing appointments, not learning marketing.

Best For: Agents who want results fast and prefer to focus on client relationships.

Both paths lead to the same destination: owning a qualification system instead of renting unqualified leads.

The Bottom Line: Stop Guessing, Start Qualifying

Finding qualified annuity leads isn't about buying more names. It's about building a system that qualifies prospects automatically before you invest time in sales conversations.

The agents closing $500K+ in annuity commissions aren't buying more leads than everyone else. They're running better qualification systems. They're building assets instead of paying for unqualified data.

The Choice:

You can keep buying unqualified leads. You can keep cold calling strangers. You can keep hoping referrals come.

Or you can build a system. A system that qualifies prospects automatically. A system that works 24/7. A system that compounds over time.

The question isn't whether you can afford to build a qualification system. It's whether you can afford not to.

Next Steps:

- Start Learning: Get our free ad scripts to see how the system works

- Build It Yourself: Learn the complete framework with our S.C.A.L.E. course

- Get It Done For You: Explore our done-for-you service if you want results without the learning curve

The old model is broken. The new model is here. The only question is: when are you going to make the switch?

The agents who switch now will dominate the next decade. The agents who don't will keep buying unqualified leads and hoping something changes.

Which one are you?