Social Media Marketing for Financial Advisors

Most financial advisors treat social media like a hobby. They post occasionally. They share market updates. They hope someone sees it and calls them. This isn't marketing. This is publishing. Publishing without a system doesn't generate leads.

The top 1% of advisors use social media differently. They don't just post content. They build branded lead generation systems. They run video ads that educate prospects before asking for meetings. They convert social media traffic into booked appointments. The results are dramatic: 25-40% conversion rates versus 2-5% for cold outreach.

Social media marketing for financial advisors is using platforms like Facebook, LinkedIn, and Instagram to build trust and generate leads through educational content, video advertising, and automated conversion funnels. Most advisors post content and hope for referrals. Top advisors use video ads that educate prospects before asking for meetings, resulting in 25-40% conversion rates versus 2-5% for cold outreach.

Posting content is free. Generating leads requires a system.

Why Most Advisors Fail at Social Media Marketing

Most articles tell advisors to "be active on LinkedIn" or "post educational content." This advice is incomplete. It's like telling a restaurant owner to "cook good food" without explaining how to get customers in the door.

The Posting-Without-Purpose Problem:

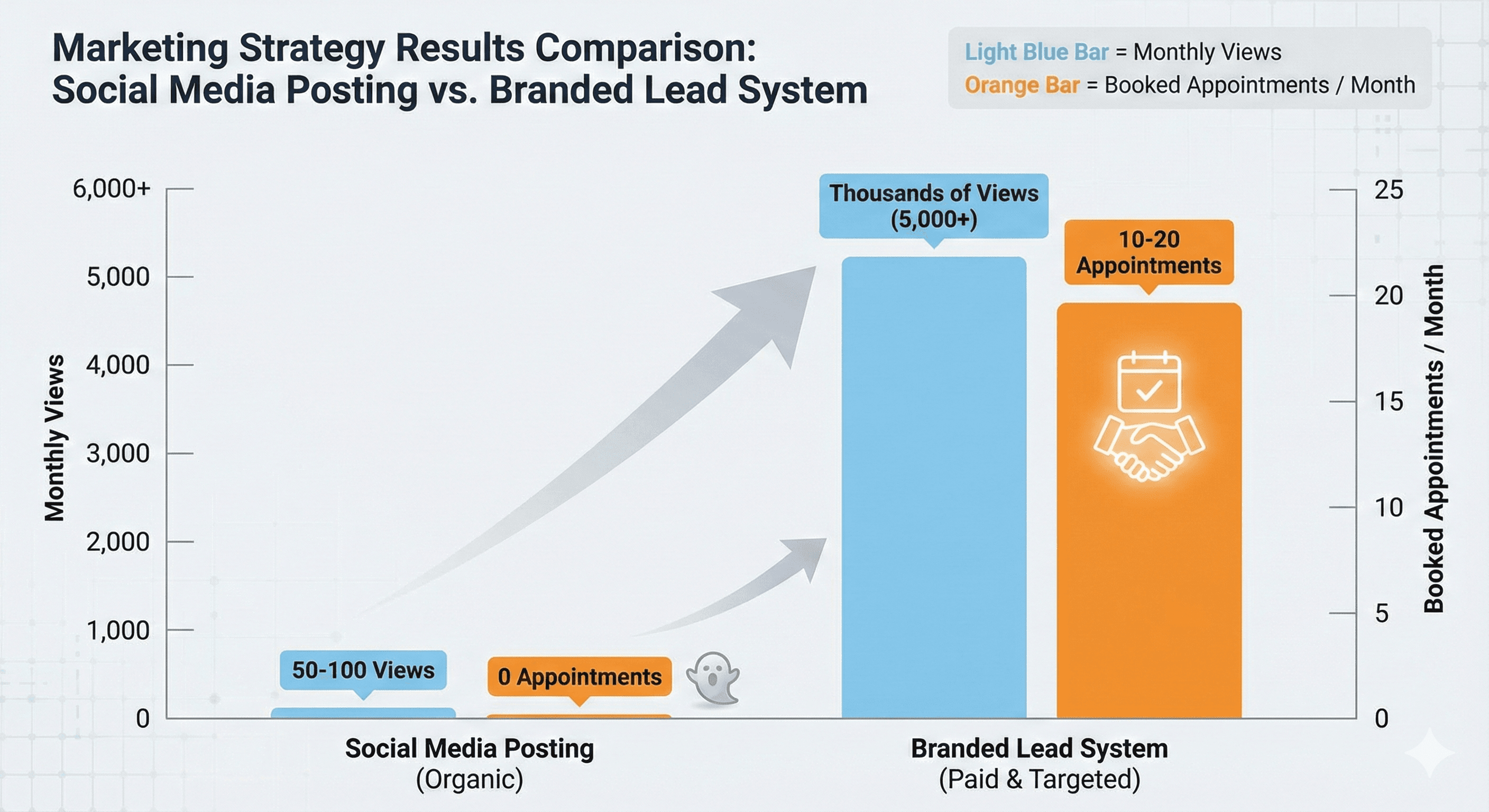

You post market updates. You share articles. You comment on industry news. You get 50-100 views per post. Maybe someone likes it. Maybe someone shares it. But no one books an appointment. You're creating content that doesn't convert.

The math: 30 posts per month × 50 views = 1,500 impressions. Zero appointments. Zero clients. Your time investment: 10-15 hours per month. Your return: nothing measurable.

The Platform Confusion Problem:

You try to be everywhere. LinkedIn on Monday. Facebook on Wednesday. Instagram on Friday. X when you remember. You're spread thin. You can't maintain quality or consistency. You're doing everything poorly instead of one thing well.

Each platform has different algorithms, audiences, and best practices. Trying to master all of them is like trying to speak five languages fluently. You end up speaking none of them well.

The Engagement Trap:

You get excited when a post gets 20 likes. You think you're building a following. But likes don't pay bills. Comments don't close deals. Shares don't generate revenue. You're measuring the wrong metrics.

Engagement is a vanity metric. The only metric that matters is booked appointments. If your social media activity doesn't lead to booked appointments, you're wasting time.

The Referral Waiting Game:

You post content hoping clients will share it. You wait for referrals. You hope someone sees your post and thinks "I should call this advisor." This is hope-based revenue. It's not a system. It's not scalable. It's not predictable.

Referrals happen when they happen. You can't control timing. You can't control quality. You can't control volume. If you want to grow, you need a system that generates leads on demand.

The Branded Lead System: How Top Advisors Actually Use Social Media

Top advisors don't use social media to build a following. They use it to build a lead generation system. Here's how it works:

Phase 1: Trust Building at Scale (Video Ads)

You run short-form video ads (30-90 seconds) on Facebook, Instagram, and LinkedIn. These aren't sales pitches. They're micro-educational moments that position you as the expert.

Example ad script:

"Most people don't realize their 401(k) has hidden fees eating 1-2% of their returns every year. If you have $500K saved, that's $5,000-$10,000 per year in fees you don't even know you're paying. Here's how to find out if your plan is costing you money..."

The ad doesn't sell. It educates. It builds authority. It creates curiosity. It makes prospects think "This advisor knows something I don't."

Prospects who watch 10-15 of these ads start recognizing your face, your voice, your expertise. When they see your booking page, they're not thinking "Who is this advisor?" They're thinking "I've seen this advisor before. They know what they're talking about."

Use our Free Agent Ad Scripts to get started. These scripts are designed to be filmed in minutes and address specific client pain points.

Phase 2: The Conversion Funnel

Your video ads drive to a dedicated landing page. The page has one job: capture contact information in exchange for a high-value offer.

The Offer Formula:

- Specific (not "Free Consultation")

- Valuable (solves a real problem)

- Low commitment (doesn't require a sales call)

Examples:

- "Get Your Free Retirement Readiness Score: See if You're On Track to Retire Comfortably"

- "Download: The 5 Questions Every 50+ Year Old Should Ask Before Choosing a Financial Advisor"

- "Free Analysis: How Much You Actually Need to Retire (Calculator Included)"

The page includes social proof (testimonials, case studies), addresses objections, and has a single, clear call-to-action. It's not a website. It's a conversion machine.

Phase 3: Automated Nurture Sequence

Once a prospect enters your system, automation takes over. They receive a sequence of emails and text messages that:

- Deliver the promised content

- Answer common questions

- Pre-frame the sales conversation

- Build urgency without being pushy

This sequence runs 24/7. You're not manually following up. The system is working while you sleep.

Phase 4: The Warm Appointment

By the time a prospect books a call with you, they've:

- Watched 10-15 of your videos

- Consumed your educational content

- Received multiple touchpoints from your automated sequence

- Self-qualified by taking action

You're not making a cold call. You're having a consultation with someone who already trusts you.

The Results:

- Show rate: 85-95% (vs. 30-40% for cold leads)

- Close rate: 40-60% (vs. 5-15% for cold leads)

- Cost per client: $150-500 (vs. $2,500-$5,000 for cold leads)

The difference isn't the platform. It's the system.

Platform Selection: Where Should You Focus?

There's no single best platform for financial advisors. The best platform is where your ideal clients spend time. Here's how to choose:

LinkedIn: Professional Networking and B2B

Best for: Advisors targeting business owners, executives, and professionals.

Strengths:

- Professional context (people expect business content)

- B2B targeting options

- Long-form content performs well

- Networking opportunities

Weaknesses:

- Higher cost per click

- Slower engagement

- More formal tone required

Posting Cadence: Several posts per week (3-5 posts)

Content Strategy: Share industry insights, case studies, thought leadership. Use LinkedIn for building authority, not direct lead generation.

Facebook and Instagram: Consumer Reach and Video Ads

Best for: Advisors targeting consumers, retirees, and families.

Strengths:

- Massive reach (billions of users)

- Excellent video ad targeting

- Lower cost per click

- Visual content performs well

Weaknesses:

- Less professional context

- Algorithm changes frequently

- Requires more content volume

Posting Cadence: Facebook (several posts per week), Instagram (daily posts)

Content Strategy: Run video ads that drive to landing pages. Use organic posts to maintain visibility and build community.

X (Twitter): Real-Time Updates and Thought Leadership

Best for: Advisors who want to establish thought leadership and engage in real-time conversations.

Strengths:

- Fast-paced engagement

- Real-time news and updates

- Direct client communication

- Thought leadership opportunities

Weaknesses:

- Requires multiple posts per day

- Short attention spans

- Less effective for direct lead generation

Posting Cadence: Multiple microblogs per day (5-10 posts)

Content Strategy: Share quick insights, engage with industry conversations, build personal brand. Use for visibility, not direct conversion.

YouTube: Educational Authority Building

Best for: Advisors who want to establish long-term authority and rank in search results.

Strengths:

- Long-form educational content

- Search engine visibility

- Evergreen content library

- Authority building

Weaknesses:

- Time-intensive to produce

- Slower to see results

- Requires consistent publishing

Posting Cadence: One high-quality video per week

Content Strategy: Create educational series, answer common questions, build a library of valuable content. Use for long-term authority, not immediate lead generation.

The Reality: Most advisors should focus on one or two platforms. Trying to master all platforms leads to mediocre results everywhere. Pick the platforms where your ideal clients spend time and where you can maintain consistency.

The Content Strategy That Actually Converts

Your social media content should serve three purposes: connect, invite, and educate.

Content Type 1: Connect (Humanize Your Business)

This content makes you relatable. It shows prospects you're a real person, not just a sales machine.

Examples:

- Share your team's successes

- Introduce new employees

- Showcase volunteer work

- Reflect on recent local events

- Take polls to engage your audience

- Share behind-the-scenes moments

Goal: Build personal connection and trust. Make prospects feel like they know you before they meet you.

Content Type 2: Invite (Create Opportunities)

This content offers prospects a way to engage with you without commitment.

Examples:

- "Join our free webinar: Retirement Planning for 50+"

- "Book a free consultation to review your portfolio"

- "Download our free guide: 5 Questions to Ask Before Choosing an Advisor"

- "Attend our in-person event: Estate Planning Workshop"

Goal: Convert passive followers into active prospects. Give them a low-commitment way to engage.

Content Type 3: Educate (Build Authority)

This content positions you as the expert. It answers questions your ideal clients have.

Examples:

- "Most people don't realize their 401(k) has hidden fees. Here's how to find them..."

- "The biggest retirement mistake I see: not accounting for healthcare costs. Here's why..."

- "Tax season tip: If you're over 50, you can contribute extra to your 401(k). Here's how much..."

Goal: Build trust through education. Make prospects think "This advisor knows what they're talking about."

The Mix: Don't post only educational content. Don't post only personal stories. Mix all three types. A good ratio: 50% educate, 30% connect, 20% invite.

The Format: Video performs best for educational content. People watch videos more than they read text. Short videos (30-90 seconds) get the most engagement. Use video for education. Use text and images for connection and invitations.

The SEC Marketing Rule: What You Can Now Do

The SEC's updated marketing rule changed everything. Most advisors still don't realize what's possible.

What Changed:

- You can now proactively ask clients for testimonials

- You can use third-party reviews (Google, Yelp, etc.)

- You can highlight ratings and endorsements in your marketing

- You can feature client success stories

What You Still Can't Do:

- Selectively ask only happy clients for testimonials (must give all clients equal opportunity)

- Write or edit testimonials yourself

- Use testimonials that are misleading or untrue

- Make specific investment performance claims

How to Use It in Social Media:

Include client testimonials in your video ads. Feature Google reviews on your landing pages. Use case studies that show real results. Share client success stories (with permission) in your posts.

Example post:

"Just helped Sarah, 58, restructure her retirement plan. She was paying $8,000 per year in hidden 401(k) fees. We moved her to a lower-cost plan and saved her $6,000 annually. That's $60,000 over the next 10 years. This is why we do what we do. #RetirementPlanning #FinancialAdvisor"

The rule isn't a restriction. It's permission to market like every other industry. Most advisors aren't using it yet. This is your competitive advantage.

The Math That Changes Everything

Let's compare two approaches:

Traditional Social Media Marketing (Posting Only):

- Time: 10-15 hours per month (creating and posting content)

- Cost: $0 (just your time)

- Impressions: 1,500-3,000 per month

- Engagement: 50-100 likes/comments per month

- Appointments: 0-1 per month (if you're lucky)

- Clients: 0-1 per quarter

- Cost per client: Your time (effectively $0, but no results)

Branded Lead Generation System (Video Ads + Funnel):

- Time: 5-10 hours per month (mostly closing appointments)

- Cost: $2,000-5,000 per month (ad spend + service/education)

- Impressions: 50,000-200,000 per month

- Engagement: Thousands of video views

- Appointments: 15-25 booked per month

- Clients: 10-20 closed per month

- Cost per client: $150-500

The branded system costs money but delivers measurable results. Traditional posting costs time but delivers nothing measurable.

The ROI Calculation:

Traditional: 10 hours × $0 results = $0 per hour

Branded System: 10 hours × 15 clients × $3,000 average client value = $4,500 per hour

The difference isn't the tactic. It's the system. Posting content is publishing. Running video ads with conversion funnels is marketing.

What Most Advisors Get Wrong About Social Media

Mistake #1: Posting Without a Goal

You post because you think you should. You don't know what you're trying to achieve. Every post should have a purpose: connect, invite, or educate. If it doesn't serve one of these purposes, don't post it.

Mistake #2: Trying to Be Everywhere

You can't maintain quality across five platforms. Pick one or two. Master them. Then consider adding a third. Quality over quantity always wins.

Mistake #3: Measuring the Wrong Metrics

Likes don't matter. Comments don't matter. Shares don't matter. The only metric that matters is booked appointments. If your social media activity doesn't lead to booked appointments, you're doing it wrong.

Mistake #4: Posting and Praying

You post content and hope someone sees it and calls you. This is hope-based revenue. You need a system that converts traffic into leads. Posting is step one. You also need landing pages, offers, and automation.

Mistake #5: Ignoring Video

Text posts get 50-100 views. Video posts get 500-2,000 views. Video ads get 10,000-50,000 views. Video is where the attention is. If you're not using video, you're invisible.

Mistake #6: Not Using the SEC Rule

The SEC says you can use testimonials. Most advisors still don't. This is free competitive advantage. Use it.

Mistake #7: Expecting Immediate Results

Social media marketing takes 30-60 days to optimize. Most advisors quit after two weeks because they don't see results. Patience compounds. Consistency compounds. Give it time to work.

The Two Paths to Social Media Success

You have two options:

Path 1: Learn and Build It Yourself

This requires investing in education and dedicating 10-20 hours per week to learning ad platforms, video creation, copywriting, and funnel construction. The upfront cost is time, but you own the system forever.

Our S.C.A.L.E. course teaches financial professionals the complete framework for building branded lead systems using social media. You learn how to create video ads, build funnels, set up automation, and optimize for ROI. It's the most powerful long-term investment you can make in your practice.

Timeline: 60-90 days to see consistent results

Investment: Education cost + ad spend ($2,000-5,000/month)

ROI: Once optimized, you own a system that generates leads for years

Path 2: Done-For-You Service

If you need results faster and have the capital, a done-for-you service builds and manages the entire system for you. You receive exclusive, warm appointments directly in your calendar.

We offer a done-for-you branded lead service that handles everything: ad creation, funnel building, automation setup, and optimization. You focus on closing appointments, not learning marketing.

Timeline: 30-60 days to see consistent results

Investment: Monthly service fee + ad spend

ROI: Predictable cost-per-acquisition with minimal time investment

Both paths work. The choice depends on your timeline, capital, and long-term goals. But both paths lead to the same destination: owning a marketing system instead of hoping for referrals.

The Bottom Line: Stop Posting, Start Marketing

Social media marketing for financial advisors isn't about posting content and hoping someone calls. It's about building a system that converts social media traffic into booked appointments.

The advisors generating 10-20 clients per month from social media aren't posting more than everyone else. They're running better systems. They're using video ads, conversion funnels, and automation. They're treating social media as a marketing channel, not a publishing platform.

The question isn't whether you can afford to build a branded lead system. It's whether you can afford not to.

If you're ready to stop posting and start marketing, get our free ad scripts to see how the system works. Or explore our done-for-you service if you want results without the learning curve.

The old model is broken. The new model is here. The only question is: when are you going to make the switch?