Content Marketing for Financial Advisors: The System

Most financial advisor content marketing advice is backwards. It tells you to blog. Post on LinkedIn. Share market updates. Create infographics. These aren't strategies. They're publishing activities. Publishing without a system doesn't generate leads. It generates vanity metrics.

The top 1% of advisors don't just create content. They build systems that turn content into branded leads. Prospects watch their videos 10-15 times before booking. They trust their expertise. They want to work with them specifically. This isn't content marketing. It's lead generation with content as the vehicle.

Content marketing for financial advisors is creating educational content (videos, articles, posts) that builds trust and positions you as an expert before prospects book appointments. The goal isn't just publishing—it's building a system that turns content into branded leads. Prospects watch your videos 10-15 times, learn from your expertise, and book appointments with 40-60% close rates versus 5-15% for cold outreach.

Publishing content doesn't generate leads. Systems do.

The Content Marketing Trap: Publishing vs. Marketing

Most advisors confuse publishing with marketing. They write blog posts. They post on LinkedIn. They share market updates. They think they're doing content marketing. They're not. They're publishing content that no one sees.

Here's the difference:

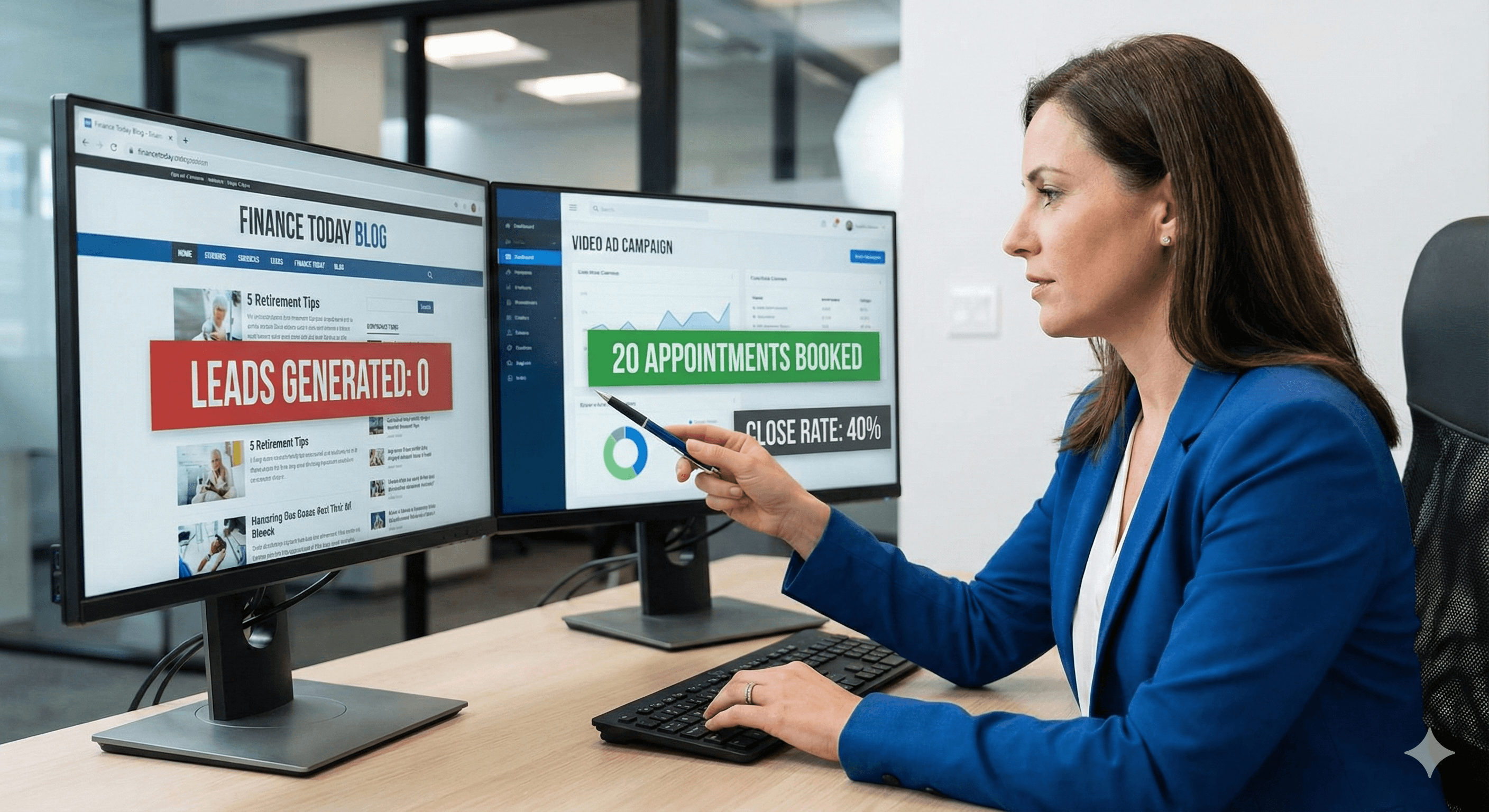

Publishing:

- You create content

- You post it online

- You hope someone finds it

- Result: 50-200 views, zero leads

Marketing:

- You create content

- You distribute it to your target audience (paid ads)

- You capture leads with conversion funnels

- You nurture prospects with automated sequences

- Result: 10-20 warm appointments, 40-60% close rate

Most advisors are publishers. They're creating content without distribution. Without conversion. Without a system. That's why their content marketing "doesn't work."

Why Traditional Content Marketing Fails for Financial Advisors

The Organic Reach Problem:

Organic social media reach is dead. LinkedIn posts reach 3-5% of your followers. Facebook posts reach 2-4%. Even if you have 1,000 followers, your post reaches 30-50 people. That's not marketing. That's shouting into the void.

The math: You spend 2 hours writing a blog post. It gets 100 views. Zero leads. Your effective hourly rate: $0. You'd make more money working at McDonald's.

The SEO Waiting Game:

SEO takes 6-12 months to work. Maybe. Most advisors don't have 12 months to wait. They need leads now. Plus, Google rankings aren't guaranteed. Competitors can outrank you. Algorithm changes can bury you. Relying on SEO alone is hope-based marketing.

The Engagement Illusion:

Getting likes and comments feels good. But engagement doesn't pay bills. You can't deposit likes. You need booked appointments. Most advisors mistake engagement metrics for business results. They're not the same thing.

The Time Sink:

Content creation takes time. Writing blog posts. Creating graphics. Editing videos. Most advisors spend 10-20 hours per week on content and generate zero leads. That's 40-80 hours per month wasted on activities that don't convert.

The problem isn't the content. It's the missing system. Content without distribution is just publishing. Content without conversion is just entertainment. You need both.

The Branded Lead System: How Content Actually Generates Leads

The top 1% of advisors use content as part of a branded lead system. It's not separate. It's integrated. Here's how it works:

Phase 1: Trust Building at Scale (Video Ads)

You run short-form video ads (30-90 seconds) on Facebook, Instagram, and TikTok. These aren't sales pitches. They're micro-educational moments that position you as the expert.

Example video ad script:

"Most people don't realize their 401(k) has hidden fees eating 1-2% of their returns every year. If you have $500K saved, that's $5,000-$10,000 per year in fees you don't even know you're paying. Here's how to check your 401(k) statement to find these fees..."

The ad doesn't sell. It educates. It builds authority. It creates curiosity.

Prospects who watch 10-15 of these ads start recognizing your face, your voice, your expertise. When they see your booking page, they're not thinking "Who is this advisor?" They're thinking "I've seen this advisor before. They know what they're talking about."

Use our Free Agent Ad Scripts to get started. These scripts are designed to be filmed in minutes and address specific client pain points.

Phase 2: Content Distribution (Paid Ads)

You don't wait for organic reach. You pay to put your content in front of your target audience. This lets you control:

- Who sees your content (demographics, interests, behaviors)

- When they see it (day, time, frequency)

- How often they see it (retargeting, lookalike audiences)

Most advisors post content and hope. Top advisors pay to distribute and know exactly who sees it.

Phase 3: Lead Capture (Conversion Funnel)

Your video ads drive to a dedicated landing page. The page has one job: capture contact information in exchange for a high-value offer.

The offer must be:

- Specific (not "Free Consultation")

- Valuable (solves a real problem)

- Low commitment (doesn't require a sales call)

Examples:

- "Get Your Free Retirement Readiness Score: See if You're On Track to Retire Comfortably"

- "Download: The 5 Questions Every 50+ Year Old Should Ask Before Choosing a Financial Advisor"

- "Free Analysis: How Much You Actually Need to Retire (Calculator Included)"

The page includes social proof (testimonials, case studies), addresses objections, and has a single, clear call-to-action.

Phase 4: Automated Nurture (Email & SMS Sequences)

Once a prospect enters your system, automation takes over. They receive a sequence of emails and text messages that:

- Deliver the promised content

- Answer common questions

- Pre-frame the sales conversation

- Build urgency without being pushy

This sequence runs 24/7. You're not manually following up. The system is working while you sleep.

Phase 5: The Warm Appointment

By the time a prospect books a call with you, they've:

- Watched 10-15 of your videos

- Consumed your educational content

- Received multiple touchpoints from your automated sequence

- Self-qualified by taking action

You're not making a cold call. You're having a consultation with someone who already trusts you.

The Results:

- Show rate: 85-95% (vs. 30-40% for cold leads)

- Close rate: 40-60% (vs. 5-15% for cold leads)

- Cost per client: $100-300 (vs. $2,500-$5,000 for cold leads)

The difference isn't the content. It's the system.

The Math That Changes Everything

Let's compare the two models:

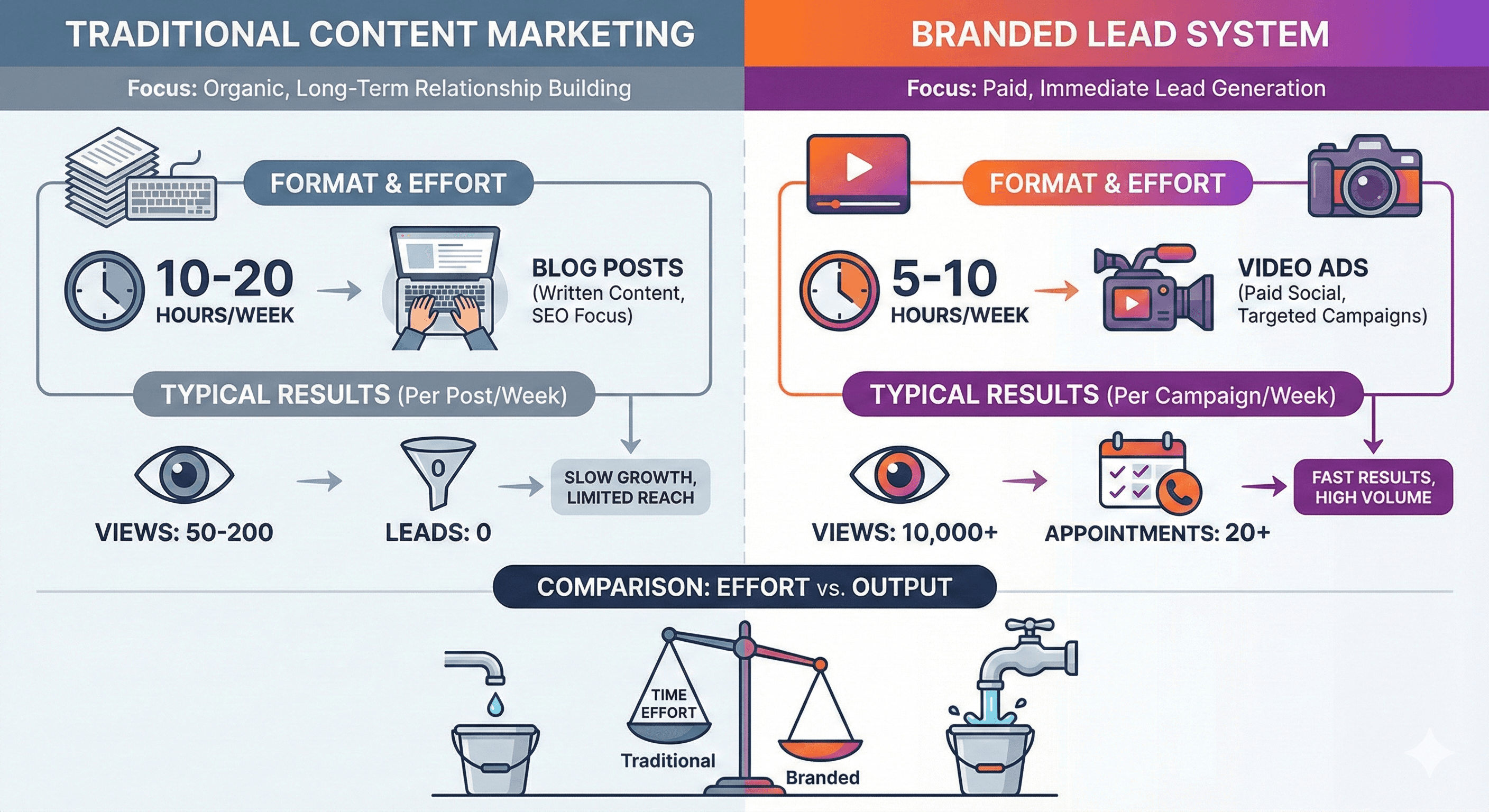

Traditional Content Marketing (Blogging/Posting):

- Time: 15 hours/month (creating, writing, posting)

- Cost: $0 (just your time)

- Views: 500-1,000 total

- Leads: 0-2 (if you're lucky)

- Cost per lead: Infinite (you can't divide by zero)

- Effective hourly rate: $0-10

Branded Lead System (Video Ads + Funnel):

- Time: 5-10 hours/month (mostly closing appointments)

- Cost: $2,000-5,000/month (ad spend + tools)

- Views: 50,000-100,000 (paid distribution)

- Appointments: 15-25 booked

- Clients: 10-20 closed

- Cost per client: $100-300

- Effective hourly rate: $300-600

The branded system costs money upfront but delivers actual results. Traditional content marketing is free but generates zero ROI. Free doesn't mean better. It means worthless.

What Types of Content Actually Work

Not all content is created equal. Here's what works for financial advisors:

1. Short-Form Video Ads (30-90 seconds)

Video ads that educate on specific topics perform best. They're easy to consume. They build trust quickly. They scale through paid distribution.

Topics that work:

- "3 Hidden Fees in Your 401(k) That Cost You Thousands"

- "Social Security Claiming Strategies That Most People Get Wrong"

- "How Much You Actually Need to Retire (The Real Number)"

- "The 401(k) Rollover Mistake That Costs You 20% of Your Retirement"

2. Educational Landing Pages

Long-form content (1,500-3,000 words) that answers specific questions. This content ranks for SEO while serving as a lead magnet.

Examples:

- "The Complete Guide to 401(k) Rollovers: What Your Employer Doesn't Tell You"

- "Social Security Optimization: How to Maximize Your Benefits"

- "Retirement Planning for 50+ Year Olds: The 5 Steps You Must Take Now"

3. Automated Email Sequences

Pre-written email sequences that nurture prospects after they download your content. These don't require daily work. They run automatically.

What Doesn't Work:

- Generic market updates ("Markets are up today!")

- Personal posts without education ("Here's my morning coffee!")

- Long-form video without distribution (YouTube videos with 50 views)

- Blog posts without SEO strategy or promotion

- Infographics that don't answer specific questions

The key: Content must answer questions prospects are already asking. Not what you want to say. What they need to know.

The Content Creation Framework

Here's how to create content that actually generates leads:

Step 1: Identify Client Pain Points

Listen to your clients. What questions do they ask? What problems do they have? What keeps them up at night? These are your content topics.

If clients ask "How much do I need to retire?" create content answering that. If they ask "Should I roll over my 401(k)?" create content on that.

Don't create content you think is interesting. Create content that solves problems prospects already have.

Step 2: Choose the Right Format

Video for awareness and trust-building. Written content for SEO and lead magnets. Email sequences for nurture. Use the format that matches the goal.

Step 3: Write for Your Audience, Not Yourself

Most advisors write like they're talking to other advisors. They use jargon. They assume knowledge. They sound smart but confuse prospects.

Write like you're explaining to a friend. Use simple language. Avoid financial jargon. Make it easy to understand. Your goal isn't to impress. It's to educate.

Step 4: Include a Clear Call-to-Action

Every piece of content needs a next step. Watch another video. Download a guide. Book a call. Without a CTA, content is just entertainment.

Step 5: Distribute Through Paid Ads

Don't wait for organic reach. Pay to put your content in front of your target audience. This ensures the right people see it at the right time.

The Compliance Question: What You Can and Can't Do

Most advisors worry about FINRA compliance. Here's the reality:

What You Can Do:

- Educate on financial concepts

- Explain strategies and approaches

- Share general market information

- Use testimonials (with proper disclaimers under new SEC rules)

- Create educational content that positions you as an expert

What You Can't Do:

- Make specific investment recommendations

- Guarantee returns or performance

- Make misleading claims

- Use testimonials that aren't representative

The key: Educate, don't promote. Focus on teaching, not selling. When in doubt, have compliance review your content before publishing.

Most compliance concerns are about what you say, not that you're creating content. Stay educational. Stay compliant.

The Two Paths: Build It Yourself or Get Help

You have two options:

Path 1: Learn and Build It Yourself

This requires investing in education and dedicating 10-20 hours per week to learning ad platforms, video creation, and funnel building. The upfront cost is time, but you own the system forever.

Our S.C.A.L.E. course teaches financial professionals the complete framework for building branded lead systems. You learn how to create video ads, build funnels, set up automation, and optimize for ROI. It's the most powerful long-term investment you can make in your practice.

Timeline: 60-90 days to see consistent results

Investment: Education cost + ad spend ($2,000-5,000/month)

ROI: Once optimized, you own a system that generates leads for years

Path 2: Done-For-You Service

If you need results faster and have the capital, a done-for-you service builds and manages the entire system for you. You receive exclusive, warm appointments directly in your calendar.

We offer a done-for-you branded lead service that handles everything: ad creation, funnel building, automation setup, and optimization. You focus on closing appointments, not learning marketing.

Timeline: 30-60 days to see consistent results

Investment: Monthly service fee + ad spend

ROI: Predictable cost-per-acquisition with minimal time investment

Both paths work. The choice depends on your timeline, capital, and long-term goals.

Why Most Advisors' Content Marketing Fails

Here are the common mistakes:

Mistake #1: Publishing Without Distribution

Creating content and posting it isn't marketing. You need paid distribution to reach your target audience. Organic reach is dead.

Mistake #2: No Conversion System

Content without a funnel doesn't generate leads. You need landing pages, opt-in forms, and automated sequences. Content alone is just publishing.

Mistake #3: Wrong Content Topics

Creating content you think is interesting instead of content prospects need. Your content must answer questions they're already asking.

Mistake #4: Giving Up Too Early

Content marketing takes 30-90 days to optimize. Most advisors quit after 30 days when they don't see results. Patience compounds.

Mistake #5: Focusing on Engagement Over Leads

Likes and comments don't pay bills. You need booked appointments. Don't mistake engagement metrics for business results.

Mistake #6: Trying to Do Everything

You can't be an expert at financial planning, video creation, ad buying, funnel building, and automation. Focus on what you do best. Outsource or learn the rest.

The Bottom Line: Stop Publishing, Start Marketing

Content marketing for financial advisors isn't about creating content. It's about building systems that turn content into leads.

The advisors managing $50M+ in assets aren't better writers. They're running better systems. They're using content as part of a branded lead generation framework that delivers predictable, scalable results.

The question isn't whether you should create content. It's whether you'll build a system that turns that content into booked appointments.

If you're ready to stop publishing and start marketing, get our free ad scripts to see how the system works. Or explore our done-for-you service if you want results without the learning curve.

Content without a system is just publishing. Content with a system is lead generation. The difference changes everything.