Insurance Broker Advertising: Strategies That Generate Qualified Leads

Most insurance broker advertising fails.

You spend $5,000 on Google Ads. You get 1,000 clicks. You close 5 clients. That's $1,000 per client. Your ROI is terrible.

Insurance broker advertising is paid promotion that drives qualified prospects to your agency through channels like Google Ads, Facebook Ads, and LinkedIn Ads. The best advertising educates prospects before they click, captures contact information through landing pages, and nurtures leads through automated email sequences.

Here's how top brokers generate exclusive appointments for $150-500 per client. And why most brokers waste $5,000 monthly on clicks that don't convert.

System-focused advertising closes 10x more deals at one-fifth the cost of traffic-focused campaigns.

Why Most Broker Advertising Fails

Brokers fail because they focus on traffic, not conversions.

Weak approach: Run Google Ads. Send traffic to homepage. Hope they call.

Strong approach: Run Facebook video ads. Educate prospects. Send them to a landing page. Capture their email. Nurture for 7-14 days. Convert to appointment.

The difference? One focuses on clicks. The other focuses on systems.

Here's the math:

- Traffic-focused advertising: 1-3% conversion rate. $1,000-2,000 per client.

- System-focused advertising: 25-40% conversion rate. $150-500 per client.

System-focused advertising closes 10x more deals at one-fifth the cost.

The 3 Advertising Channels That Actually Work

1. Facebook and Instagram Video Ads

These platforms work because you can educate before asking for a meeting.

How it works:

- Create 10-15 short videos (30-60 seconds) answering common questions.

- Run video ads targeting your ideal client (age, location, interests).

- Prospects watch multiple videos before clicking your link.

- They land on a page that captures their contact info.

- An automated email sequence nurtures them.

- They book when ready.

Why it works:

Prospects see your face 10-15 times before you talk. They already trust you. When they book, they're warm appointments, not cold leads.

The numbers:

- Cost per click: $1-3

- Click to lead rate: 20-30%

- Lead to appointment rate: 15-25%

- Appointment to close rate: 40-60%

- Cost per client: $150-500

What competitors miss:

They tell you to "run Facebook ads" but don't explain the video system. They don't show you how to structure the funnel. They don't give you the ad scripts.

Get our free ad scripts to start your video ad system.

2. Google PPC Ads

Google Ads work for high-intent searches. But most brokers waste money.

How it works:

- Target keywords like "life insurance agent near me" or "best term life insurance."

- Create ads that answer the search query directly.

- Send traffic to a landing page (not your homepage).

- Capture contact information.

- Follow up immediately.

Why it works:

People searching these terms are ready to buy. They're high-intent. But you must convert them quickly.

The numbers:

- Cost per click: $5-15 (insurance keywords are expensive)

- Click to lead rate: 10-20%

- Lead to appointment rate: 20-30%

- Appointment to close rate: 40-60%

- Cost per client: $200-800

What competitors miss:

They send traffic to their homepage. Homepages don't convert. Landing pages do. Create dedicated pages for each ad campaign.

3. LinkedIn Ads (For Commercial Insurance)

LinkedIn works for B2B insurance. Most brokers ignore it.

How it works:

- Target by job title (CFO, HR Manager, Business Owner).

- Target by company size (1-50 employees, 51-200 employees).

- Create ads that address business pain points.

- Send to a landing page with business-focused messaging.

- Follow up with personalized outreach.

Why it works:

Business owners are on LinkedIn. They're researching insurance. You can reach them when they're thinking about it.

The numbers:

- Cost per click: $8-20

- Click to lead rate: 15-25%

- Lead to appointment rate: 25-35%

- Appointment to close rate: 50-70%

- Cost per client: $300-1,000

What competitors miss:

They use LinkedIn for networking, not advertising. They don't realize LinkedIn ads can target decision-makers directly.

The Advertising Funnel That Converts

Most brokers run ads that send traffic to their homepage. Homepages don't convert. Funnels do.

The Complete Funnel:

- Top of funnel: Video ads educate prospects.

- Middle of funnel: Landing page captures contact info.

- Bottom of funnel: Email sequence nurtures for 7-14 days.

- Conversion: Automated booking converts to appointment.

Why funnels work:

Each step moves prospects closer to booking. You're not asking for a meeting immediately. You're building trust first.

The numbers:

- Ad click rate: 2-5%

- Landing page conversion: 20-30%

- Email open rate: 25-35%

- Email to appointment: 5-10%

- Overall funnel conversion: 0.5-1.5%

That means 100 ad clicks = 1-2 appointments. With a 40% close rate, that's 0.4-0.8 clients per 100 clicks.

Cost per client: $150-500 (depending on ad spend and funnel optimization).

Compare that to sending traffic to your homepage:

- Homepage conversion: 1-3%

- Overall conversion: 0.02-0.09%

- Cost per client: $1,000-5,000

Funnels convert 10x better at one-tenth the cost.

How to Create Ads That Don't Look Like Ads

Most broker ads look like sales pitches. Prospects ignore them.

Weak ad: "Get the best life insurance rates! Click here for a free quote!"

Strong ad: "Wondering how much life insurance you actually need? Most agents will tell you 10x your income. But that's wrong. Here's the real math..."

The difference? One sells. The other educates.

The education-first approach:

- Answer a question. "How much life insurance do I need?"

- Provide value. "Here's the real math: take your annual expenses, multiply by years until kids are 18, add mortgage payoff, subtract existing savings."

- Build trust. "I've helped 500+ families calculate this. Here's what I learned."

- Soft CTA. "Want me to calculate your number? Book a free 15-minute call."

Prospects watch because they're learning. They click because they want more value. They book because they trust you.

The numbers:

- Education-focused ads: 3-5% click rate, 30-40% landing page conversion

- Sales-focused ads: 1-2% click rate, 10-15% landing page conversion

Education-focused ads convert 3x better.

Local Advertising Strategies for Insurance Brokers

Most brokers ignore local advertising. That's a mistake.

Why local works:

70% of insurance buyers search "insurance agent near me." If you're not visible locally, you're invisible.

Local advertising channels:

- Google Business Profile: Free. Optimize it completely. Get reviews. Post regularly.

- Local SEO: Create location-specific landing pages. Target "insurance agent [city name]."

- Local partnerships: Sponsor local events. Partner with real estate agents. Co-market with mortgage brokers.

- Community involvement: Join Chamber of Commerce. Sponsor youth sports. Volunteer at local nonprofits.

The numbers:

- Local search volume: 46% of all Google searches

- Click-through rate on #1 local result: 25-30%

- Cost per lead: $0 (organic)

- Time to rank: 3-6 months

- Monthly value: 10-50 qualified leads

Local advertising is free. But it takes time. Start today.

Compliance: What You Can and Can't Say in Ads

Insurance advertising has strict regulations. Most brokers don't know them.

What you CAN say:

- Educational content about insurance

- Your experience and credentials

- General benefits of insurance

- Your contact information

What you CAN'T say:

- Guaranteed returns or rates

- Comparisons to specific competitors

- Medical advice or diagnoses

- False or misleading claims

State regulations vary:

- Some states require disclaimers on all ads

- Some states restrict certain advertising channels

- Some states require pre-approval for certain ad types

Best practice: Include a disclaimer on all ads: "Insurance products are subject to underwriting and may not be available in all states."

What competitors miss:

They run ads without checking compliance. They get fined. They lose licenses. Always check state regulations before running ads.

The Retargeting Strategy That Converts Browsers

Most people who visit your website don't book immediately. Retargeting brings them back.

How it works:

- Install a tracking pixel on your website.

- When someone visits but doesn't book, they're added to a retargeting audience.

- Show them ads on Facebook, Instagram, or Google.

- Remind them why they visited. Offer value. Ask them to book.

Why it works:

People need multiple touchpoints before buying. Retargeting gives you those touchpoints.

The numbers:

- Website visitors who book immediately: 1-3%

- Website visitors who book after retargeting: 5-10%

- Cost per click (retargeting): $0.50-2.00 (cheaper than cold traffic)

- Cost per client: $50-200

Retargeting converts browsers into buyers at one-fifth the cost of cold traffic.

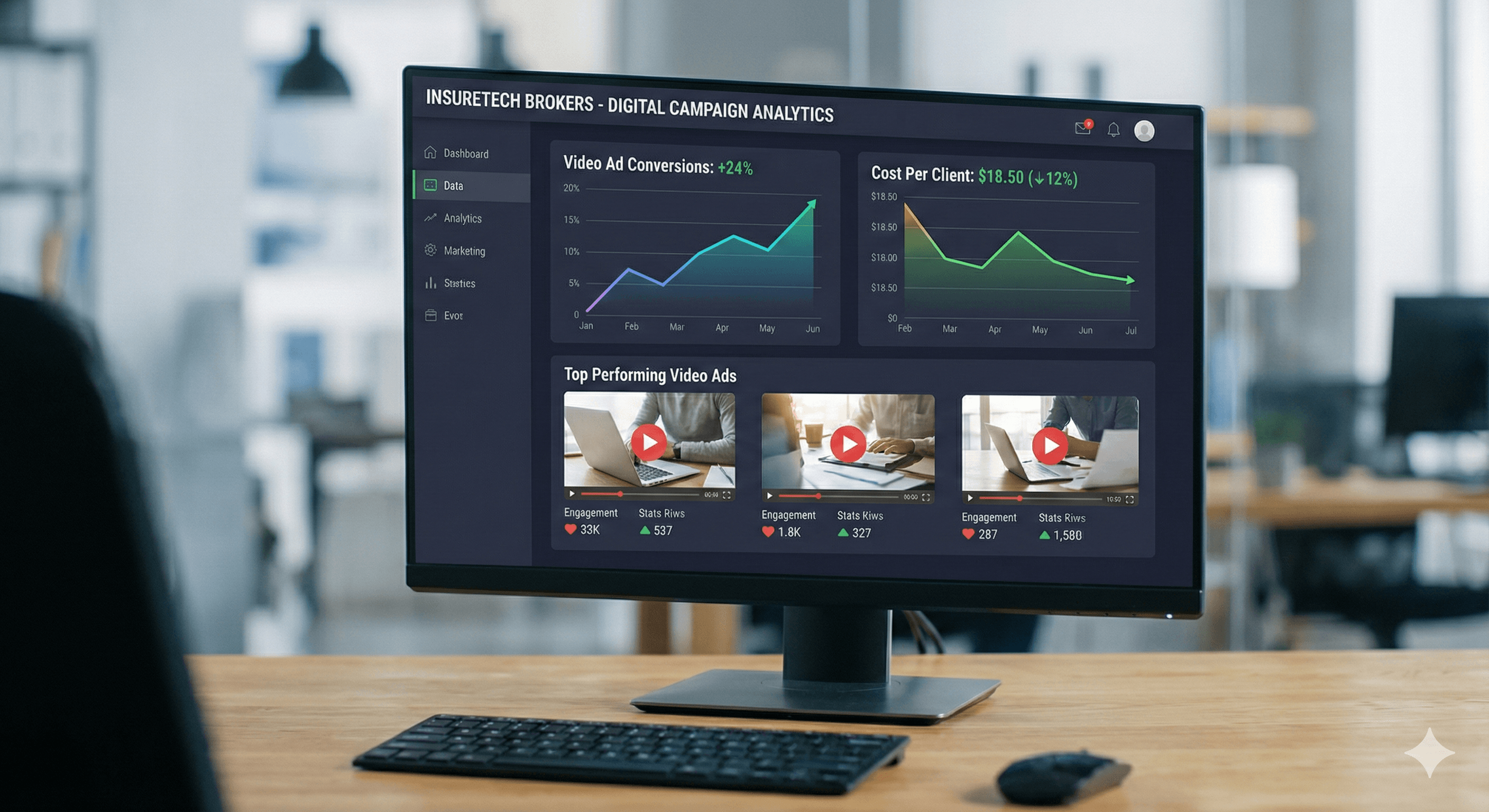

How to Track Advertising ROI (The Right Way)

Most brokers track vanity metrics. They think they're winning. They're losing.

Vanity metrics (ignore these):

- Ad impressions

- Website traffic

- Social media followers

- Email opens

Real metrics (track these):

- Cost per click

- Click to lead rate

- Lead to appointment rate

- Appointment to close rate

- Cost per client

- ROI

The formula:

Cost per client = (Ad spend + Tools + Time) / Clients closed

ROI = (Revenue per client × Clients closed) / Total advertising cost

Example:

- Monthly ad spend: $3,000

- Tools and software: $200

- Time (valued at $50/hour × 10 hours): $500

- Total cost: $3,700

- Clients closed: 12

- Cost per client: $308

- Revenue per client: $3,000

- ROI: 874%

That's good. Track these numbers. Optimize what matters.

Common Advertising Mistakes (And How to Fix Them)

Mistake #1: Sending traffic to your homepage.

Your homepage is for existing clients. Landing pages are for prospects.

Fix: Create dedicated landing pages for each ad campaign. Match the ad message to the page content.

Mistake #2: Not tracking conversions.

You know how much you spent. You don't know if it worked.

Fix: Set up conversion tracking. Know your cost per lead, cost per appointment, cost per client.

Mistake #3: Quitting too early.

You run ads for one week. You get no results. You quit.

Fix: Advertising takes 30-90 days to optimize. Give it time. Test different ads. Refine your targeting.

Mistake #4: Ignoring compliance.

You run ads without checking regulations. You get fined.

Fix: Always check state regulations. Include required disclaimers. When in doubt, consult compliance.

Mistake #5: Focusing on clicks, not systems.

You optimize for low cost per click. You get cheap traffic that doesn't convert.

Fix: Optimize for cost per client. Build complete funnels. Focus on systems, not tactics.

The Bottom Line

Insurance broker advertising isn't about spending money. It's about building systems.

The best advertising educates prospects before asking for a meeting. It uses video ads, landing pages, email sequences, and automated booking to generate exclusive appointments that convert at 40-60%.

Most brokers run ads that send traffic to their homepage. They track clicks, not clients. They waste $5,000 monthly on traffic that doesn't convert.

Top brokers build complete funnels. They track cost per client, not cost per click. They generate 20-50 exclusive appointments monthly for $2,000-5,000.

The difference isn't budget. It's strategy.

Stop running ads that look like ads. Start educating prospects through video. Build landing pages that convert. Nurture leads through email. Track real metrics.

Learn more about insurance marketing strategies.

See how our branded leads work.

Get free ad scripts to start your system.