Insurance Leads Companies: Hidden Math That Changes

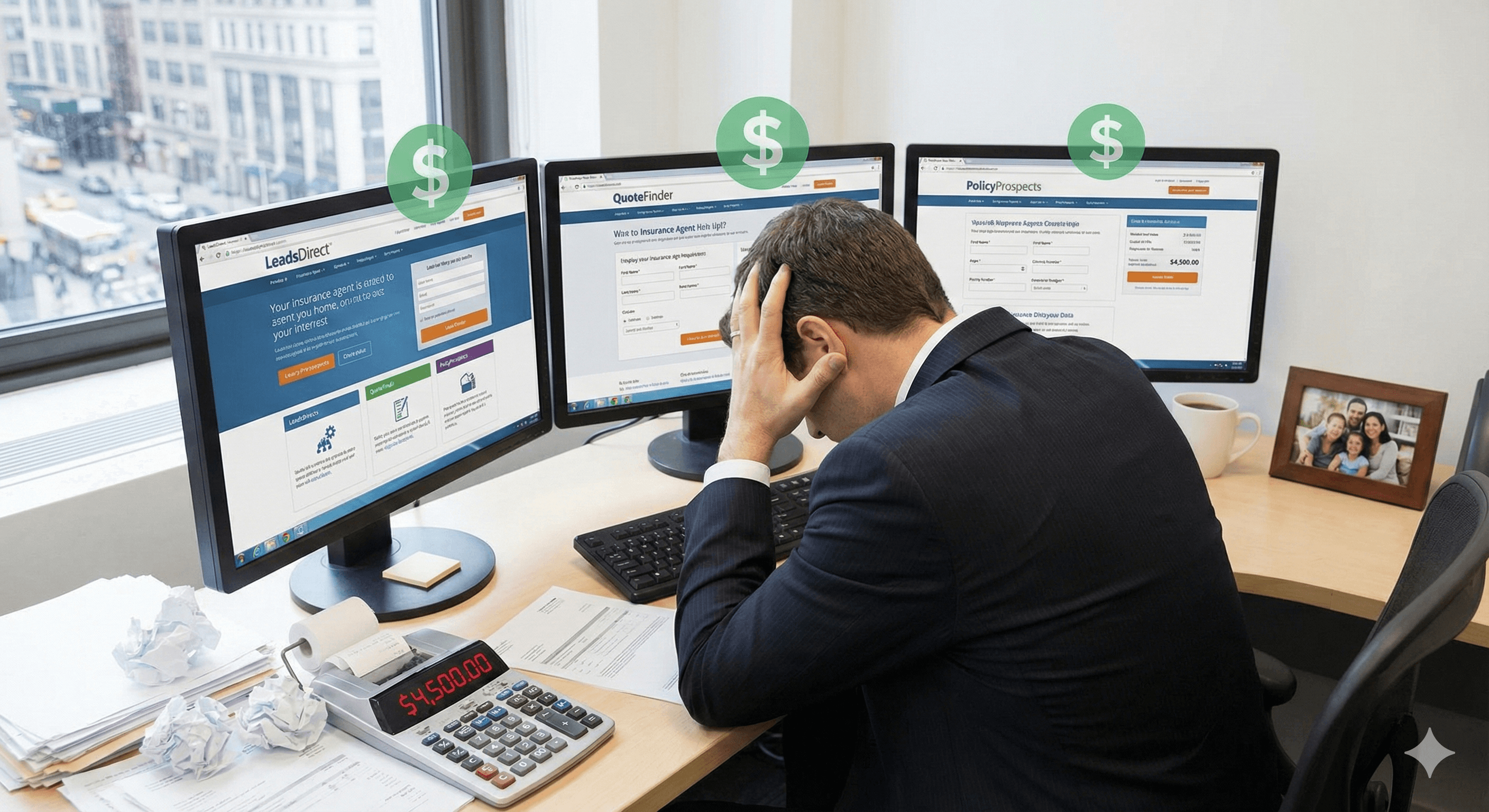

Most articles about insurance leads companies read like company directories. They list names, features, and prices. They don't tell you the truth: buying leads from companies is one of the worst investments you can make as an insurance agent.

The agents closing 50+ policies per year aren't buying leads from QuoteWizard, EverQuote, or InsuranceLeads.com. They're running systems that attract prospects who already know their name, trust their expertise, and want to work with them specifically. The difference isn't marketing budget—it's understanding the hidden math that makes lead companies profitable for them, not for you.

Insurance leads companies are brokerages that collect consumer contact information from online quote forms and sell those leads to multiple insurance agents simultaneously. Most companies sell each lead to 3-5 agents, meaning you're paying $15-50 for the right to compete with 4 other agents for the same prospect. The model is designed around volume and broker profit margins, not agent success rates, which explains why industry close rates average 5-15% and true cost per sale ranges from $500-2,500.

The hidden costs of buying leads add up faster than most agents realize.

The Shared Lead Problem: Why Companies Make Money and You Don't

Insurance leads companies are profitable because they've optimized for their business model, not yours. Here's how it works:

The Company's Business Model:

- Consumer visits a comparison website (Insurance.com, QuoteWizard, etc.)

- Fills out a form requesting quotes

- Company collects the lead

- Company sells the same lead to 3-5 agents simultaneously

- Each agent pays $15-50

- Company generates $45-250 from one form submission

The consumer gets 5 phone calls. You get a 20% chance of being the first one to answer. The company gets paid 3-5 times for the same lead.

Your Reality with Shared Leads:

Let's say you buy 100 leads at $25 each ($2,500 total):

- 100 leads sold to 5 agents = 500 total calls to those consumers

- Contact rate: 30-40% (most don't answer after the first 2-3 calls)

- Show rate: 35-45% (of those who answer)

- Close rate: 5-15% (industry average)

The Math:

- 100 leads × $25 = $2,500 investment

- 30-40 contacts made (you're not always first)

- 10-18 appointments booked (many are no-shows)

- 1-3 sales closed

Your true cost per sale: $833-$2,500

Now add your time. If you spend 2 hours per lead (calling, leaving voicemails, following up, handling objections), that's 200 hours for 1-3 sales. Your effective hourly rate: $12.50-$25 per hour. You could make more delivering pizza.

The problem isn't the companies themselves. It's the fundamental model. You're buying a commodity that's been resold multiple times. The prospect has no relationship with you, no reason to trust you, and no urgency to act. You're starting from behind on every single call.

Why "Exclusive" Leads Don't Solve the Problem

Some companies offer "exclusive" leads at $75-150 per lead. The pitch is tempting: "This lead is yours alone. No competition."

Here's what they don't tell you:

Exclusive leads still have the same fundamental issues:

- Cold prospects: The consumer doesn't know you exist. They filled out a form, not a booking request.

- No trust: You're still making a cold call. They haven't seen your content, read your reviews, or built any relationship.

- No urgency: They requested quotes from multiple sources. They're shopping, not buying.

- Higher upfront cost: $75-150 per lead means $7,500-$15,000 for 100 leads with the same 5-15% close rate.

The "Exclusive" Math:

- 100 exclusive leads × $100 = $10,000 investment

- 30-40 contacts made

- 15-25 appointments booked

- 2-5 sales closed (slightly better, but not enough)

True cost per sale: $2,000-$5,000

Exclusive leads reduce competition but don't change the fundamental problem: you're still cold calling strangers who didn't ask to hear from you specifically. The higher price tag doesn't improve your close rate enough to justify the investment.

The Real Framework: What Actually Matters When Evaluating Lead Companies

If you're going to buy leads from companies anyway (some agents do it while building their own system), here's the framework that matters:

1. Lead Freshness (Not Just Delivery Speed)

Companies boast about "real-time" delivery. That's marketing speak. What matters is:

- Time from form submission to your call: Should be under 5 minutes

- How many agents received it before you: Impossible to know, but ask about their distribution model

- Whether the lead was pre-qualified: Some companies filter for budget, timeline, and intent

The Truth: Even "fresh" leads are cold if the consumer doesn't know you. Speed doesn't replace relationship.

2. Contact Rate vs. Price

Don't compare cost per lead. Compare cost per contact. If Company A charges $25 per lead with a 40% contact rate, your cost per contact is $62.50. If Company B charges $35 per lead with a 60% contact rate, your cost per contact is $58.33.

Company B is actually cheaper, even though the per-lead price is higher.

3. Return Policy (And How Hard It Is to Use)

Most companies offer returns on uncontactable leads. The process is usually:

- Submit a return request within 48 hours

- Provide proof you attempted contact (call logs, emails)

- Wait 5-10 business days for review

- Receive credit (not refund) if approved

Reality check: By the time you jump through these hoops, you've wasted more time than the lead was worth. Return policies are marketing features, not profit drivers.

4. Industry Specialization

Some companies specialize in specific insurance types (auto, health, life). Specialized companies often have:

- Better lead quality (more targeted questions in their forms)

- Higher contact rates (consumers are more motivated)

- Better filtering options (demographics, coverage needs, budget)

Example: A company that only does life insurance leads will likely outperform a generalist for life insurance agents.

5. Integration and Automation

Can the company deliver leads directly to your CRM? Can you set up automated email sequences? Do they provide API access?

The less manual work you do, the more time you have for actual selling. But remember: automation doesn't solve the cold lead problem. It just makes failure more efficient.

The Companies Agents Actually Use (And Why They Still Struggle)

Based on industry data and agent feedback, here's what the market looks like:

EverQuote: Market leader in auto and home insurance. Advanced targeting options, user-friendly platform. Charges $20-45 per lead. Agents report 30-40% contact rates and 5-10% close rates. True cost per sale: $600-1,800.

QuoteWizard (LendingTree): Massive partner network, wide range of lead types. Charges $15-50 per lead depending on type. Agents report significant lead overlap and competitive pressure. True cost per sale: $500-2,000.

InsuranceLeads.com: Large volume, no minimums, flexible pricing. Charges $18-40 per lead. Agents report fast delivery but variable quality. True cost per sale: $700-2,500.

SmartFinancial: Real-time delivery, strong in auto/health/home. Charges $25-55 per lead. Agents report good delivery speed but expensive cost per sale. True cost per sale: $800-2,200.

ZipQuote: Verified leads, strong targeting. Charges $30-60 per lead. Agents report higher quality but limited volume. True cost per sale: $600-1,500.

Hometown Quotes: Exclusive leads, simple platform. Charges $40-80 per lead. Agents report fewer duplicates but still struggle with cold calls. True cost per sale: $1,200-3,000.

Notice the pattern: even the "best" companies result in true costs of $500-3,000 per sale. That's not a typo. That's the math.

The Alternative: Why Branded Lead Generation Destroys Lead Companies

The top 1% of insurance producers don't buy leads from companies. They generate leads using a system called branded lead generation.

The Core Difference:

Lead companies: Cold prospects who don't know you → Cold calls → 5-15% close rate

Branded system: Prospects watch your content 10-15 times → Warm booking requests → 40-60% close rate

How It Works:

Phase 1: Trust Building at Scale

You run short-form video ads (3-8 seconds) on Facebook, Instagram, and TikTok. These aren't sales pitches. They're micro-educational moments that position you as the expert.

Example: "Most people don't realize their term life insurance expires at age 65. If you're 45 and bought a 20-year term policy, you'll be uninsurable when it expires. Here's what to do instead..."

Prospects who watch 10-15 of these ads start recognizing your face, your voice, your expertise. When they see your booking page, they're not thinking "Who is this person?" They're thinking "I've seen this agent before. They know what they're talking about."

Phase 2: The Conversion Funnel

Your video ads drive to a dedicated landing page with a high-value offer:

- "Get Your Free Life Insurance Policy Audit: See if You're Overpaying or Underinsured"

- "Download: The 5 Questions Every 40+ Year Old Should Ask Before Buying Life Insurance"

The page includes social proof, addresses objections, and has a single, clear call-to-action.

Phase 3: Automated Nurture Sequence

Once a prospect enters your system, automation delivers:

- The promised content

- Educational emails

- Pre-framed sales conversations

- Urgency without pushiness

This sequence runs 24/7. You're not manually following up.

Phase 4: The Warm Appointment

By the time a prospect books a call, they've:

- Watched 10-15 of your videos

- Consumed your educational content

- Received multiple touchpoints

- Self-qualified by taking action

You're not making a cold call. You're having a consultation with someone who already trusts you.

The Results:

- Show rate: 85-95% (vs. 35-45% for cold leads)

- Close rate: 40-60% (vs. 5-15% for cold leads)

- Cost per sale: $50-150 (vs. $833-2,500 for cold leads)

The Math That Changes Everything

Let's compare the two models side-by-side:

Traditional Lead Buying (100 leads/month):

- Cost: $2,500/month

- Sales: 1-3/month

- Cost per sale: $833-2,500

- Time investment: 200 hours/month

- Scalability: Limited (more leads = more time)

Branded Lead Generation (Optimized System):

- Cost: $3,000-5,000/month (ad spend + service/education)

- Sales: 15-30/month

- Cost per sale: $100-200

- Time investment: 5-10 hours/month (mostly closing)

- Scalability: Unlimited (increase ad spend = more leads)

The branded system costs more upfront but delivers 10x the ROI. More importantly, it's an asset. Every month you run it, you're building a database of warm prospects, improving your ad performance, and creating a predictable revenue stream.

Traditional lead buying is a recurring expense with diminishing returns. Branded lead generation is a capital investment that compounds.

What Most Agents Get Wrong About Lead Companies

Mistake #1: Focusing on Price Per Lead

$15 per lead sounds great until you realize you need 50-100 leads to close one sale. The goal isn't the cheapest lead. It's the lowest cost per sale.

Mistake #2: Believing "Exclusive" Solves Everything

Exclusive leads reduce competition but don't change the fundamental problem: cold prospects with no relationship. The higher price tag doesn't improve close rates enough to justify the investment.

Mistake #3: Not Tracking True Costs

Cost per lead is a vanity metric. Cost per sale is what matters. Track contact rates, show rates, close rates, and time investment. The numbers will shock you.

Mistake #4: Treating It as a Long-Term Strategy

Buying leads can work as a temporary bridge while you build your own system. But treating it as a permanent strategy means you'll always be renting, never owning. You're building someone else's asset, not yours.

Mistake #5: Ignoring Alternatives

Most agents don't know branded lead generation exists. They assume buying from companies is the only option. Once you see the math, the alternative becomes obvious.

The Bottom Line: Stop Renting, Start Building

Insurance leads companies aren't evil. They're running a profitable business model. The problem is that model doesn't serve agents long-term.

The agents making $200K+ per year aren't buying more leads than everyone else. They're running better systems. They're building assets instead of paying for commodities.

If you're going to buy leads from companies, do it with your eyes open. Understand the true costs. Track your metrics. Use it as a bridge, not a destination.

But if you want to build something that compounds, invest in branded lead generation. Learn the system yourself or use a done-for-you service. Either way, you'll own the asset instead of renting the commodity.

The question isn't whether you can afford to build a branded lead system. It's whether you can afford not to.

If you're ready to stop buying leads and start generating them, get our free ad scripts to see how the system works. Or explore our done-for-you service if you want results without the learning curve.

The old model is broken. The new model is here. The only question is: when are you going to make the switch?